Independence

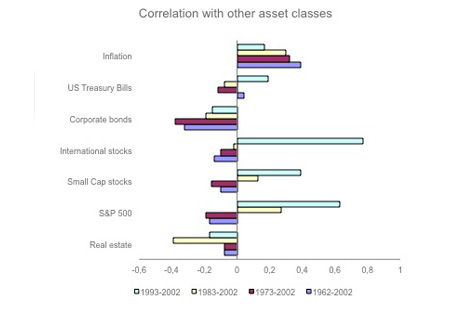

The risk-return profile of a portfolio can be improved by adding a new asset class. The diversification benefit is so much higher, the less an additional asset class correlates with the existing ones.

Correlations of Timberland have already been calculated many times.

Forestry investments traditionally have a very low to negative correlation with other asset classes.

The reasons …

- The returns from Timberland are strongly associated with timber prices. These, on the other hand, just slightly correlate with trends in the financial markets.

- There is no relationship between the market value of woodland area and the cycles of the financial markets.

- Thanks to the temporal flexibility of logging, favourable market phases can be exploited. This reduces the correlation between Timberland and the financial markets.

- Other factors, which are independent from the financial markets, can influence supply and demand and consequently also the price of wood – for example substitutes in all application areas of wood or energy policy.

The low correlation with inflation can be interpreted as a kind of hedge against the inflation.

The addition of Timberland in an investment portfolio leads to a return increase in different risk classes.